This is the time to ensure social distancing and digital payments help you do that- Narendra Modi Prime Minister of India

How to create UPI Id in DakPay UPI App by IPPB?

Here I am sharing all the steps to create UPI id Dak Pay app. Kindly follow below procedure to create UPI Id in this India Post Payments UPI application.

01. Download DakPay UPI App by IPPB from Google Play Store. You can also download it from here.

02. Just open it. The interface of this application is simple. You can see the below picture for reference.

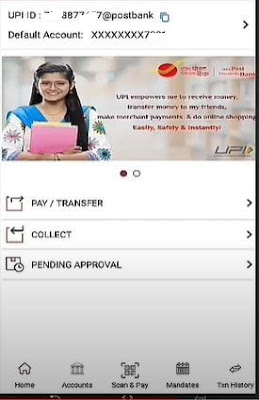

09. When you will select the bank, your account will be automatically added to the DakPay UPI application. Now you have to enter debit card details and click on the continue button and set UPI pin for the online transactions.

10. Your account will be linked to DakPay UPI App. Now you can do send/receive money, bill payments, scan and pay, etc thorough this application. The amount will be deducted from the linked account only.

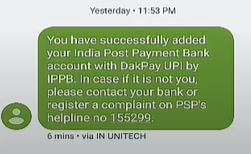

A message will also be received in your mobile. i.e. " You have successfully added your ........bank with DakPay UPI by IPPB. In case if it is not you, please contact your bank or register a complaint on PSP's helpline no 155299."

What are the Basic Features of DakPay UPI App by IPPB?

We are already using other UPI applications like Google Pay, PhonePe, PayTM, Bhim etc but these all applications are created by various private companies but the Dak Pay app is developed by India Post Payments Bank and IPPB is 100% government sector bank working under the Department of Post.

Some of the basic features of the Dak Pay UPI App are listed below:

01. Instant Transfer Money:- DakPay UPI application uses IMPS (Immediate Payment Service) for transfer of money which is faster than RTGS and NEFT payment system.

02. Available 24x7 hrs:- DakPay app is available 24 hours for any type of payment.

03. Unique UPI Id:- UPI Id created in Dak Pay by IPPB application, is unique.

04. Secure Payment:- Each transaction is protected through UPI pin, hence the changes of the fraudulent transaction are about zero

05. AePS

06. Bill Payments:

07. Pay Postal Service

DakPay UPI by IPPB App download link (apk file)

DakPay UPI apk application can be downloaded at Google Play Store. You can download it from the below link also. This application is only available for android. It will also be available soon for iphone in upcoming days.

Click here to download DakPay by IPPB

Tags: bhim dak pay up, bhim dak pay upi app, bhim dakpay by ippb, dak pay, dak pay app, dak pay app download, dak pay login, dak pay news, dak pay up, dak pay upi apk download, dak pay upi app, dak pay upi app download, dak pay upi ippb, dakpay by ippb, dakpay upi app, dakpay upi by ippb, dakpay upi by ippb app download

Frequently Asked Question (FAQs) on IPPB UPI Service and Dak Pay UPI application

Question 01. What is UPI?

Answer- Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI is built over the IMPS infrastructure and allows customers to instantly transfer money between any two parties' bank accounts.

Question 02. What is the Dak Pay UPI Application?

Answer- DakPay UPI Application is a PSP – Payment Service Provider i.e. payment application that lets you make simple, easy, and quick transactions using Unified Payments Interface (UPI). You can make direct bank payments to anyone on UPI using their UPI ID or scanning their QR. You can also request money through the app from a UPI customer.

Question 03. Where do I can find the DakPay UPI App?

Answer- The app is available on the Google Play Store (Android) /App Store(Apple) and can be downloaded.

Question 04. Who is eligible for using the DakPay UPI App?

Answer- Precisely, an Indian citizen, who is having an account (KYC compliant) with any Bank and the account must be enabled with mobile banking facility.

Question 05. What are the prerequisites to use DakPay UPI App?

Answer- These are as under-

A. Mobile enabled with Internet

B. Account no linked with same mobile number

C. Debit Card details associated with the Account

Question 06. Is it mandatory to have an India Post Payments Bank Account to use the DakPay UPI App?

Answer- No, it’s not mandatory to have an IPPB account to use the DakPay UPI App, however, it’s suggestible to have one for a better banking experience.

Question 07. What is a VPA/ UPI ID?

Answer- A VPA/ UPI ID is an identifier by which you create and link any of your bank accounts to make secure payments. The VPA/ UPI ID can be yourname@postbank or mobilenumber@postbank which is easy to remember.

Question 08. What can be a VPA/ UPI ID?

Answer- A VPA/ UPI ID can be alphabetical, numeric, or alphanumeric. It should be of a minimum of 4 characters. It cannot contain any special characters (*, #, @, etc.) except dot(.) and hyphen(-) which are permissible. Your ID should be easy to remember such as yourname@postbank or mobilenumber@postbank.

Question 09. What is a UPI PIN?

Answer- UPI PIN (UPI Personal Identification Number) is a 4 or 6 digits secret code you create/set during first time registration with this app. You have to enter this UPI PIN to authorize all transactions. If you have already set up a UPI PIN with other UPI Apps, you can use the same on Dak Pay UPI App.

Note – Application login MPIN is different from the UPI PIN.Important - Please do not share your UPI PIN with anyone. Dak Pay UPI App or IPPB does not store or read your UPI PIN details and your bank's customer support will never ask for it.

Question 10. My UPI transaction has been failed. How has my bank account been debited?

Answer- In case of failed transactions, the money (if debited) will be credited to your account instantly. In the case of timed-out transactions, the amount will be settled to the beneficiary account or debit account within two working days.

Question 11. My UPI transaction has been failed. How has my bank account been debited?

Answer- In case of failed transactions, the money (if debited) will be credited to your account instantly. In the case of timed-out transactions, the amount will be settled to the beneficiary account or debit account within two working days.

Question 12. What is the Unified Payment Interface (UPI) transaction limits?

Answer- For IPPB, account-level limits will be decided as per the bank’s policy. The upper limit mandated by NPCI is Rs 1 lakh per transaction and Rs 1 lakh cumulative transaction value. A maximum of 10 transactions can be initiated within 24 hours from the first transaction.

Also, Bank may change the transaction limits for UPI under National Payments Corporation of India (NPCI) upper limits as per the bank’s policy.

Answer- For IPPB, account-level limits will be decided as per the bank’s policy. The upper limit mandated by NPCI is Rs 1 lakh per transaction and Rs 1 lakh cumulative transaction value. A maximum of 10 transactions can be initiated within 24 hours from the first transaction.

Also, Bank may change the transaction limits for UPI under National Payments Corporation of India (NPCI) upper limits as per the bank’s policy.

Question 13. What are the different types by which I can send money using UPI?

Answer- You can send money either by using Account + IFSC (Beneficiary’s Account details) or by entering Beneficiary’s VPA or by scanning the beneficiary QR.

Question 14. I have 2 accounts with IPPB, do I need separate virtual payment addresses for each of these accounts?

Answer- You have the choice of either linking both accounts to a single VPA. In this scenario, please ensure you appropriately tag which account you would like to use as the default account to debit and which account you would like to use as the default account to credit. Alternatively, you can assign a separate VPA for each account.

Answer- You have the choice of either linking both accounts to a single VPA. In this scenario, please ensure you appropriately tag which account you would like to use as the default account to debit and which account you would like to use as the default account to credit. Alternatively, you can assign a separate VPA for each account.

Question 15. When does the refund happen in case of a failed UPI transaction?

Answer- If the transaction is failed/ void / timed out/ decline, request you to check after Transaction+2 working days the amount would be credited to the beneficiary account or refunded in your account. In case the amount does not get credited to the Beneficiary account within Transaction+2 working days nor there is any refund in your account then, we request you to call our Customer Care from your registered mobile number.

Answer- If the transaction is failed/ void / timed out/ decline, request you to check after Transaction+2 working days the amount would be credited to the beneficiary account or refunded in your account. In case the amount does not get credited to the Beneficiary account within Transaction+2 working days nor there is any refund in your account then, we request you to call our Customer Care from your registered mobile number.

Question 16. What if I lose my phone?

Answer- Even if you lose your phone, the UPI PIN required to authorize all transactions will not be known to a third person and hence they will not be able to use the Dak Pay UPI App. In addition, please contact our customer support immediately for necessary support and securing the account.

Answer- Even if you lose your phone, the UPI PIN required to authorize all transactions will not be known to a third person and hence they will not be able to use the Dak Pay UPI App. In addition, please contact our customer support immediately for necessary support and securing the account.

Question 17. How can I track my transaction status in UPI?

Answer- You can check your transaction status using the "UPI Transaction History" button in DakPay UPI application.

Question 18. Can I continue to use the existing IPPB Mobile banking App post installing of Dak Pay UPI and is it allowed?

Answer- Yes, these two are two separate applications and there will not be any restrictions on using both at a time, on the same mobile, and with the same account details.

Question 19. Can I continue to use the existing login Mobile Banking MPIN after installing Dak Pay UPI App?

Answer- No, you will have to create a 4-digit login PIN afresh.

Question 20. Debit Card is mandatory for setting UPI PIN?

Answer- Yes, you can use your existing Debit Card issued to you and the expiry details to set the UPI PIN.

Question 21. Can I continue to use my existing Virtual Payment Address [VPA] which was created in any other BHIM/ UPI application?

Answer- No, you will have to create your VPA again. Using IPPB, the VPA handler is @postbank.

Answer- No, you will have to create your VPA again. Using IPPB, the VPA handler is @postbank.

Question 22. Will my existing beneficiary list be carried over/ auto fetched to Dak Pay UPI App? Answer- No, your existing beneficiary list will not be carried over/ auto fetched to Dak Pay UPI app. You will have to register a beneficiary before transferring funds through UPI.

Question 23. I am maintaining multiple accounts in two or more Banks, but only one Bank has my mobile number updated with the account; will I be able to access accounts of all the banks that are yet to update?

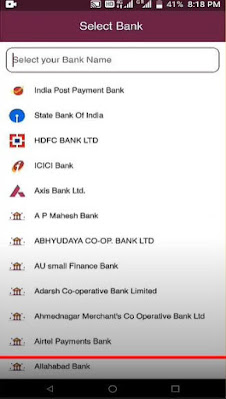

Answer- NO, you will be able to access the accounts of the banks where your mobile number is updated. The account can be added to Dak Pay UPI App by selecting the respective Bank from BANK NAME drop-down list.

Question 24. Why am I not able to connect on Dak Pay UPI?

Answer- The reasons may be:

A. Your account may have become Dormant/inactive.

B. Mobile Number from which you are trying to sign in may not be registered to your account.

C. Customer is having Mode of Operation which is not eligible for UPI services such as Joint/ Anyone or survivor, former or survivor, etc.

D. You are having an account with multiple customer IDs.

Question 25. How secure is Dak Pay UPI App?

Answer- The application is fully secure with the following security features:

A. Unified Payment Interface is highly secured as it works on two-factor authentication (2FA), one being registered Mobile Number and second, being UPI PIN incorporated with dedicated NPCI secured library.

B. Device/SIM Binding with handset IMEI number.

C. System validates customer Mobile Number, Device IMEI number, and SIM serial number at the time of login.

Question 26. I am currently using Third-Party apps like Google Pay etc., however will I be able to use the Dak Pay UPI App?

Answer- Yes, you can use the application with no such restrictions.

Question 27. What happens if a wrong UPI PIN is entered?

Answer- The transaction you have initiated will fail if you enter a wrong UPI PIN.

Question 28. I cannot find my bank account once I select the bank name. What should I do?

Answer- You must ensure that your mobile number is linked to the bank account you are trying. Also, you must make sure that the same mobile number is registered with Dak Pay UPI App. If they are not the same, you cannot access the bank account details on the app or transact with them.

Question 29. Are UPI transactions possible only during the bank business hours?

Answer- UPI transactions can be done at any time of the day; it need not necessarily be within the bank business hours.

Question 30. Money has been debited from my account but I have not received any confirmation message. What should I do?

Answer- Upon completing a transaction, you must see a success status on your Dak Pay App. Also, an SMS will be sent to your registered mobile number from your bank. Sometimes, it may take longer to receive the confirmation message due to operator issues. However, it is recommended to contact the customer support of your bank if you do not receive a confirmation within an hour from the time of completing the transaction.

Question 31. Should I add beneficiary before making a fund transfer via UPI?

Answer- No. Like the NEFT/RTGS transactions, you do not have to add a beneficiary in advance to make a fund transfer. With UPI, you need to have the virtual ID, account number + IFSC, or QR image of the recipient to initiate the fund transfer.

Question 32. Must the recipient have a bank account to make a UPI transfer? Does it work with a wallet app?

Answer- It is mandatory for the recipient to have a bank account to get funds transferred via UPI. You cannot link a wallet to UPI.

Question 33. Is it possible to put a stop payment request for a transfer made through UPI?

Answer- No. Once you initiate a payment via UPI, you cannot stop the payment.

Question 34. How long does it take for the money to get credited into the beneficiary account? Answer- Money gets credited into the beneficiary account instantly.

Question 35. Will the customer receive any intimation from the bank for completion of the transaction?

Answer- On successful completion of the transaction, alerts will be sent to the customer's registered mobile number with the bank.

Question 36. Where do I register a complaint with reference to the UPI transaction?

Answer- Beneficiary Customer can log complaint through the complaints segment of the Dak Pay UPI App. Also can reach out to IPPB customer care with transaction details.

Question 37. My mobile verification process is failing repeatedly. Why?

Answer- Mobile Verification fails occur due to the following reasons:

A. App is unable to send SMS(for device verification)

B. Network connection is not working

Kindly ensure network connectivity (Mobile Data switched on & Flight Mode turned off) and in case the above issues are not applicable, kindly upgrade the app to the latest version from Playstore/Appstore and try again.

Question 38. Why does Dak Pay UPI App show “SMS Sending Failed” while mobile registration?

Answer-

A. Kindly ensure network connectivity (Mobile Data switched on & Flight Mode turned off)

B. You should have sufficient balance to send an SMS for registration. SMS fee may change according to your Telecom Service Provider. \

C. Please ensure that you’re not switching screens (switching between different applications) in between the process of registration, doing so would automatically expire your session.

Question 39. Why am I not able to login to my Dak Pay UPI App even after entering my passcode?

Answer-

A. Kindly ensure network connectivity (Mobile Data switched on & Flight Mode turned off).

B. Kindly ensure that you’re entering your correct passcode. In case you don’t remember your passcode, click on the “Forgot Passcode” option from the passcode screen.

Question 40. What does “unable to fetch a/c” or “account does not exist” mean?

Answer-

A. If your app says “Unable to fetch A/c”, kindly wait for few minutes and try again later as the bank may be offline.

B. In case you’re trying to link a Minor A/c or Joint A/c, the bank wouldn’t allow you to add that particular account on Dak Pay UPI App. Kindly check with your bank for the same.

C. In case you are trying to link an account type not supported by your Bank’s internal policy (Minor, Joint, Dormant A/c, etc.), kindly contact the bank.

D. If your app says “Account does not exist”, ensure that you’ve selected the correct Bank A/c and that you’ve linked your mobile number to that Bank account.

E. In the case of Dual SIM, kindly ensure that you’ve selected the correct SIM to which you’ve linked your bank account.

Question 41. I am not able to remove my bank account from Dak Pay UPI app.

Answer- Login to Dak Pay UPI App -> Click on Manage Bank Account You will be shown the list of accounts you’ve linked on App, associated to which you can use “options” to remove your that particular account.

Question 42. I am not able to set my UPI Pin. What should I do now?

Answer-

A. The last 6 digits and expiry date of the debit card is required for setting the UPI PIN.

B. If you’re not receiving the OTP in time, kindly click on resend OTP option.

C. If the above does not work, please wait for some time and try again.

D. Please note that only Debit cards linked to the account can be used for setting the UPI Pin.

Question 43. Why do Dak Pay UPI App show “wrong debit card details” while trying to set UPI Pin?

Answer- This error would occur only in the event of entering incorrect Debit Card details. In any case, if the same scenario is repeated post entering the correct details, Kindly contact your bank.

Question 44. Why am I not able to send money?

Answer-

A. You can send money to a limit of Rs. 40,000 per transaction.

B. If you’re sending money to a VPA, please, make sure that you’ve entered the correct VPA.

C. Kindly ensure that you’ve entered the correct UPI Pin.

D. You will not be able to send money if your Bank is offline/ malfunctioning.

E. If you’re a new user on Dak Pay UPI, you can only do transactions up to Rs. 5000 for the first 24 hours. You’ll be able to exhaust your daily limit of Rs. 40,000 after the completion of the aforementioned 24 hours.

F. Kindly note that your Bank’s(linked accounts) limit may vary from that of Dak Pay UPI App.

Question 45. Why Do I See “Risk Threshold Exceeded”?

Answer- A user on Dak Pay UPI App can complete only 10 financial transactions in a day for a value, not beyond Rs. 40,000. Beyond this limit on frequency or value of transactions, you will be shown an error “Risk threshold exceeded”.

Question 46. Money sent but not credited to the receiver. What should a customer do?

Answer-

A. If your app states that your transaction is a success, but your beneficiary hasn’t received the money, Kindly check to ensure that you’ve entered the correct beneficiary details (UPI ID or A/c + IFSC).

B. In case your transaction is in Pending status kindly check the status of the transaction after T+1 working days. If the issue still persists, kindly reach out to our customer care.

C. In case your transaction has failed, but the amount was debited then the same will be reversed to you in T+2 working days.

D. If you still face the issue, you can reach out to us or raise a complaint on your app

Question 47. Money sent to the wrong receiver. Can I reverse the transaction?

Answer- You will not be able to reverse it by yourself, Kindly contact your bank and raise a complaint about chargeback.

Question 48. How to use the scan & pay feature for sending money?

Answer- Scan & pay option is present on the Home page where you can click and the QR scanner opens up. Using this you can scan the QR code of the receiver and send him money. You can also use scan and pay on your passcode screen. You can also upload a QR saved on your phone as an image.

Question 49. Can customers save the beneficiary details for later transactions?

Answer- Yes, the customer can save details. While sending money to a particular receiver you have to click on the option “Save for Future”

Question 50. How Do I Generate My QR Code?

Answer- Once you register on Dak Pay UPI, a QR code and default VPA is created and the QR associated will be available, user can check these details on the “My Profile” section of the application.

Question 51. What Is Money/Collect Request?

Answer- On Dak Pay App, you can initiate a collect transaction for asking for money from someone. You have to enter the amount and UPI ID. The user who will receive the request can pay or decline the collect request by authenticating it with the UPI pin.

Question 52. How do I check collect requests made to me?

Answer- You can click on the Pending Approvals menu on the home screen, collect requests made towards you will be displayed. You can approve or decline the same.

Question 53. Is there a limit on the amount of money that can be received using Dak Pay per transaction?

Answer- There is a limit of Rs. 2,000 per collect request on Dak Pay UPI App.

Question 54. How to block unknown money requests?

Answer- You can do so by clicking on the “Block” option for the request and also by clicking the particular sender so that he can no longer send unwanted requests.

Question 55. Is there a time frame within which the money request has to be accepted?

Answer- Pending transactions can be viewed in the transaction section of the Application. The requests will be valid till the time the initiator has kept them. If the request is not accepted within that set time, the request expires.

2 Comments

Can we link my other bank account and transfer the money from this account to SSA using Dak Pay app ? And how?

ReplyDeleteyes, You can link any bank to DakPay app for UPI Payment. After linking the bank account, you can transfer money to SSA account. SSA account should be open in post office.

Delete