Calculate your maturity amount through Mahila Samman Savings Certificate scheme Calculator right now here.

Mahila Samman Savings Certificate Yojana 2023- Key features

It is a totally new savings scheme that is announced by Finance Minister Nirmala Sitharaman during the speech on budget 2023.

Indian women and girls can open a Mahila Samman Bachat Patra account in any post office through offline mode.

A maximum of 2 Lakh rupees is permissible to invest in this scheme for a period of two years.

You will get higher returns through this scheme after maturity because it gives us a 7.5% internet rate annually (quarterly compounding).

Partial withdrawal is also allowed in the Mahila Samman Savings Certificate yojana.

- Name of the scheme- Mahila Samman Savings Certificate Yojana or Mahila Samman Bachat Patra Yojana

- Interest rate- 7.5% per annam

- Maturity period- two year

- Eligibility- allowed for Indin women and girls

- Where to open- in any post office across India

Where to open Mahila Samman Savings Certificate (MSSC) account

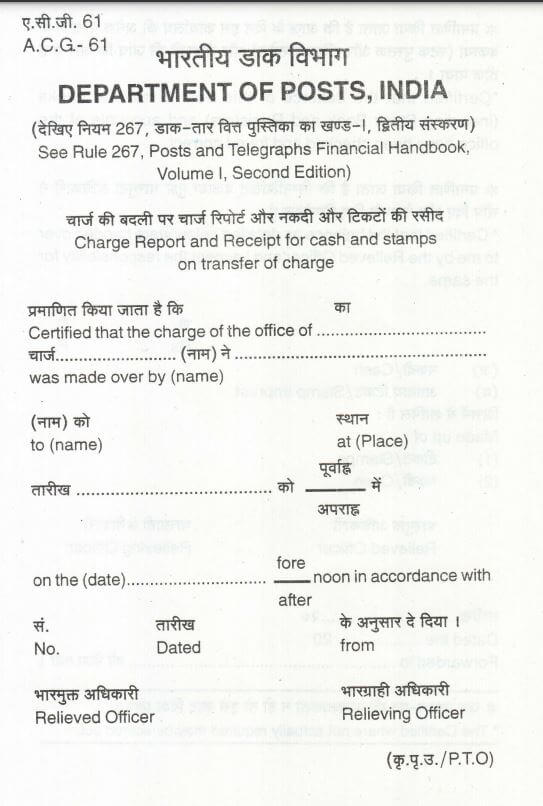

All post offices are authorized for Mahila Samman Savings Certificate Yojana where you can open an MSSC account from 01st April 2023 to 31st March 2025.

Just visit the nearest post office to open Mahila Samman account. If you don't know your nearest post office then check here is post office open today or not.

Fill MSSC account opening form and submit it along with your KYC documents such as your Aadhar card, pan card, and 2 passport-size photographs to the post office.

Post office staff will open an MSSC account in the system and provide you a Mahila Samman Bachat Patra account passbook which contains all the information related to your account number, CIF ID number, address, etc.

Mahila Samman Savings Certificate Yojana Eligibility

Women and girls are eligible to open Mahila Samman Savings Certificate accounts. This scheme is restricted to male citizens of India.

Eligibility to open an account under Mahila Samman scheme is as under-

- Only Females (women and girls) can open accounts under this scheme.

- She must have a Resident of India. A foreigner can't be eligible for the MSBP scheme.

- Her Age must be in between 18-60 years

- Adhar Card must be required for KYC purposes.

Mahila Samman Savings Certificate Yojana Interest Rate 2023

Mahila Samman Savings Certificate Yojana Calculator (MSSC Calculator)

MSSC Maturity Amount calculation with example

Mahila Samman Savings Certificate Yojana VS other savings scheme

Mahila Sammaan Savings Certificate scheme is a more powerful investment tool other than Public Provident Fund (PPF), Sukanya Samriddhi Yojana, Senior Citizen small savings scheme (SCSS) Monthly Investment Scheme (MIS), Fixed Deposit (FD), and Recurring Deposit (RD).

Mahila Samman Yojana is more profitable than other savings schemes due to its various features. There are under-

- Higher interest rate i.e. 7.5 percent per year

- low maturity period- only two year

- Compounding - yearly

- Higher returns after maturity

- Only females (women and girls) can open a Mahila Samman account.

![IPPB Credit Card apply online, launch with pnb bank [latest news]](https://blogger.googleusercontent.com/img/a/AVvXsEi6WtLdiYJGGzVuYawN1tPs99yXO5yVK3FTWlrFmqqRuCZb1UwmS_rZXoHWkMqK9wuQ8zaVi9XHqXpdc3NKg0GA8zH5Q490VkbaW_WKpXxF3FUV8xXXPuImEpqn3bh8-zdUOqPsMSr7w1hcudiWDsUcXZJMjS5NPIwIKuI2XE7_BB_cBud9_5EXeYkHkA=w680)

0 Comments