How to activate IPPB Virtual Debit Card? (Procedure for IPPB virtual debit card apply online)

As we know that every IPPB customer wants to get their IPPB debit card. But many people did not know how to get IPPB virtual debit card apply online. But after reading this blog they will also able to get a debit card for IPPB account. It is a very simple process. They can get a virtual debit card of India Post Payments Bank by applying a request in the IPPB Mobile application.

Before applying for IPPB RuPay virtual debit card online in the IPPB mobile app, the application should be updated in the latest version 1.0.0.13. The latest version of this application is available at Google Play Store.

01. Just open IPPB Mobile Application.

02. Click on Cards. Below screen will appear.

03. Click on Virtual Debit Card.

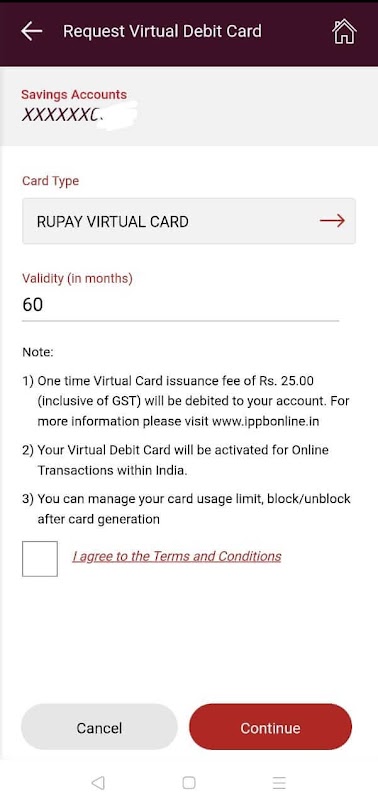

04. Accept terms and conditions and click on the continue option to request for IPPB Virtual Debit Card.

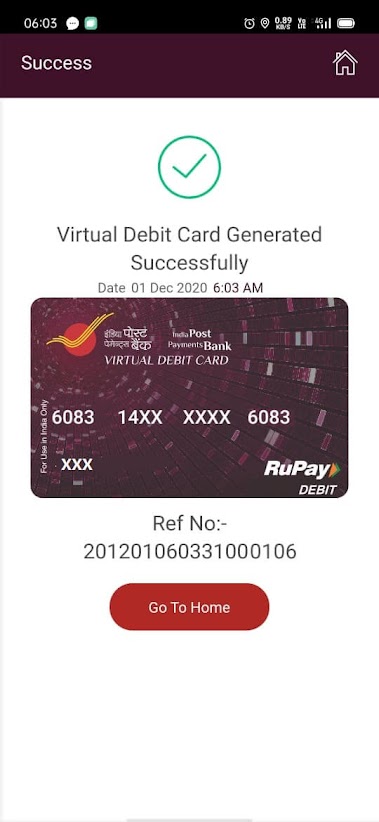

05. It will be activated after ten days. When it will be generated that you will get notified by IPPB. See screenshot of notification.

How IPPB Virtual Debit Card works?

I have already explained the process of applying for Virtual Debit Cards in IPPB. This process is simple and very easy. There is no paperwork, lengthy verification, or credit check to go through. You can be approved and receive your virtual debit card direct to IPPB mobile application. It includes a 16-digit card number, expiry date, and CVV2 number.

It is called a “virtual” card because you use it for online purchases where an actual card will not be required. You can use your virtual debit card on any website that takes Visa or Mastercard – Amazon, eBay, and more!

One time virtual debit card issuance fee is Rs. 25.00 (including GST). The issuance fees will be debited to your IPPB account.

It is a Rupay card means it will work only in India. You can not do international transactions through this IPPB debit card. It will be activated for online transactions within India.

What is the transaction limit of IPPB Virtual Debit Card?

The transaction limit of the virtual debit card of the India Post Payments Bank is between Rs. 0 to Rs. 50000. You can change the limit but it should be between Rs. 0 to Rs. 50000.

Read Also: Dak Pay new UPI App launched by IPPB bank-Know all features of Dak Pay UPI by IPPB Application

Benefits of the IPPB Virtual debit card?

It is a debit card of India Post Payments Bank that works like other bank debit cards. It is not available as physical but it will be used at any shopping mall/online payment/online shopping to pay the payment.

Here I am sharing some specific key features of this IPPB Virtual Debit Card.

01. Instant Availability, No credit checks, no lengthy verification – The process to get IPPB Virtual debit card is a quick, and simple process that means anyone can apply for their virtual debit card through IPPB mobile application.

02. Universal Acceptance: IPPB virtual debit cards can be used to make online purchases with retailers around the world who accept Visa or Mastercard as a payment method.

03. Secure Payment: IPPB virtual card details are sent straight to your email inbox. Because it is working as a normal debit card hence the payment system which was done through this virtual card is highly secure.

04. Self Generated: It is a self-generated debit card of IPPB from IPPB Mobile Banking App. You can also block or unblock this card at any time through the Mobile Banking app of India Post Payments bank.

05. Set per day limit: It is one of the most important key features of the IPPB RuPay virtual debit card because user can also set their own per day limit for online transactions.

Know IPPB Debit card charges

As per information released by the India Post Payments Bank, issuance fees of Rs. 25.00 (including GST) will be charged by IPPB. It may be called IPPB debit card charges. It will be deducted from the customer account after the issuance of RuPay debit card.

As we already mentioned the IPPB debit card is a virtual card hence apart from the issuance fees, there will no extra charges exposed by India Post Payments Bank in the form of IPPB Debit card charges. Check more about IPPB virtual debit card charges.

- Card Type: RuPay Classic Virtual Debit Card

- Virtual card issuance charges: Rs. 25/- (including GST)

- Transaction charges: NIL

- Online transaction charges at e-commerce websites: NIL

- Reissuance charges: NIL

- Card Block charges: NIL

- Card Unblock charges: NIL

- IPPB UPI charges: NIL

- IPPB SMS charge: Rs. 10/- +GST per quarter

- Service charges for IPPB doorstep Banking

What is UPI Service of India Post Payments Bank?

I am glad to share the latest news of IPPB that India Post Payments Bank has now been started the UPI service to their customers. As the Bank is now live with UPI, going forward users can make direct bank payments to anyone using their UPI ID or scanning their QR. Users can also request money through the app from a UPI customer. UPI service is now available in IPPB Mobile Banking Application. Apart from it, IPPB customers can also register in various UPI applications link Bhim, Phone pe, Google Pay, etc. by using an IPPB account.

IPPB Mobile Banking Application- IPPB offers a state-of-the-art, simple, secure, and easy-to-use Mobile banking service through a mobile app to access your IPPB account and carry out transactions from the convenience of your mobile phone.

The full form of UPI is Unified Payments Interface means it is an immediate real-time payment system that helps in instantly transferring the funds between the two bank accounts through a mobile platform.

How to register UPI service in IPPB Mobile Application?

Recently, India Post Payments Bank has been released the latest version of the IPPB Mobile application. Bhim UPI option is available in the latest version of the IPPB Mobile app. Here I am sharing the procedure to activate the UPI service in the IPPB account.

01. Update the IPPB Mobile Application (recommended).

02. Open IPPB Mobile App and click on Bhim UPI option.

03. Click on manage UPI ID. App will generate your UPI Id.

05. Now you can avail of the UPI payment system from IPPB saving account link send money, request money, etc.

Key features of UPI service in IPPB Mobile Banking

The IPPB mobile banking services are hosted on a platform that is modern, secure, and convenient. Currently available services on Mobile Banking are as under:-

- Account balance inquiry

- Request for a statement of your account

- Transfer funds within the bank

- Transfer funds to other bank accounts

- Pay water, electricity, and utility bills

- Recharge prepaid and DTH services

- Manage your funds with the linked POSA (Post Office Savings Account) by using Sweep-in and Sweep-out facility

- Payments of several Department of postal services

What are the new services after enabling UPI in IPPB Mobile Banking Application?

These are as under:-

1. Send Money: Using this option, one can send money to anyone using Virtual Payment Address (VPA), Account no & IFSC and QR Scan. Additionally, one can also transfer money using Mobile No. (Mobile No should be registered with Bank or *99# and account should be linked).

2. Request Money: Using this option, one can collect money by entering Virtual Payment Address (VPA).

3. Scan & Pay: Using this option, you can pay by scanning the QR code through Scan & Pay & generate your QR option is also present.

4. UPI Transactions: Using this option, one can check transaction history and also pending UPI collect requests (if any) and approve or reject. You can raise a complaint about the declined transactions by clicking on Report issue in transactions.

5. Profile: Using this option, one can view the static QR code and Payment addresses created. User can also share the QR code through various messenger applications like WhatsApp, Email, etc. available on phone and can also download the QR code.

Methods for sent and request money through IPPB UPI service

Money can be sent or requested with the following methods:

Virtual Payment Address (VPA) or UPI ID: Send or request money from/to bank account mapped using VPA.

Mobile number: Send or request money from/to the bank account mapped using mobile number.

Account number & IFSC: Send money to the bank account.

Aadhaar: Send money to the bank account mapped using Aadhaar number.

QR code: Send money by QR code which has enclosed VPA, Account number, and IFSC or Mobile number

How to add IPPB bank in Google Pay, Phone Pe, and Bhim?

As we already know that India Post Payments Bank has been started UPI service for their customers. It means IPPB user can also register in UPI applications like Google Pay, Phone Pe, and Bhim.

You must have IPPB virtual Debit card to register in Google Pay, Phone Pe, and Bhim UPI applications through IPPB account.

Check to make sure that your bank works with UPI. If it doesn’t, your bank account won’t work with Google Pay.

You might need to give Google Pay permission to send a verification SMS to your bank.

01. Download Google Pay, Phone Pe, Bhim from Google Play Store.

02. In the top right corner, click on the three dots.

03. A new page will appear, here tap on 'Payment Methods'.

04. It will direct you to a new page here, click on 'Add Bank Account'.

05. Numerous options will be displayed, choose your 'Bank name' from the list.

06. After selecting a bank, a pop-up will appear, tap 'Allow'.

05. Numerous options will be displayed, choose your 'Bank name' from the list.

06. After selecting a bank, a pop-up will appear, tap 'Allow'.

07. Another pop-up will appear showing the account link, click 'Ok'.

08. A verification SMS will be sent; after that, your mobile number will be verified and after that your account. It is totally an automated process.

08. A verification SMS will be sent; after that, your mobile number will be verified and after that your account. It is totally an automated process.

09. After verification, a new page will be displayed. Now tap on 'Enter UPI PIN' to link the New Bank account. or Enter Debit card Detail (enter your IPPB virtual debit details)

10. As you enter Debit card details, the bank account would be linked to the Google Pay app.

Frequently Asked Question on IPPB Bank Virtual Debit Card

Question 01- What is IPPB Bank Virtual Card?

Answer- IPPB Bank Virtual Card is the Digital Debit Card of India Post Payments Bank, which can be used for online transactions at any e-commerce website. The Debit Card can be used to shop online at any merchant website/ online portals in India that accepts RuPay Cards, without any difference from a regular plastic Card.

Question 02- What is an e-commerce (online) transaction?

Answer- E-commerce is commonly known as Electronic commerce, which refers to the buying and selling of products or services over electronic systems such as the Internet/ website.

Question 03- Is my IPPB Debit Card safe?

Answer- Yes, the customer details like IPPB bank account number, mobile no. and email address registered with IPPB bank are not shared with any Merchant / Vendor. All the transactions done through the debit card of IPPB are validated via OTP as a second-factor authentication.

Question 04- Which type of customers can have an IPPB Debit Card?

Answer- IPPB customers having a Mobile Banking facility with transaction rights/access can avail of the services of IPPB Rupay debit card.

Question 05- Will my debit card be activated for transaction also, after generation?

Answer- Yes, once a debit card generated, it will be activated for any type of online transaction within India.

Question 06- Can IPPB customers withdraw Cash/transaction on point of sales (POS) machines using IPPB bank Virtual Card?

Answer- No, the Rupay Debit Card can only be used for making online payments on various eCommerce websites, and those websites, where Rupay Debit cards are accepted as payment gateways.

Question 07- What are the IPPB debit card charges? (for issuance or annual fee)

Answer- Yes, Rs. 25 including GST is the issuance charges of debit cards. There are no annual charges/fees for using an IPPB bank debit card.

Question 08- If any unauthorized person has seen my Virtual Card details, can he use it for fraudulent online transactions?

Answer- As the debit card usage is protected through OTP (One Time Password), which is only sent to the customer’s registered mobile number, the chances of fraudulent transactions are very low. However, the customer must take adequate precautions.

Question 09- Can current account holder and savings accounts holder issue the virtual debit card?

Answer- Yes, virtual debit can be issued for both types of accounts.

Question 10- Can a minor (below 10 years of age) have a Virtual debit card?

Answer- No, a virtual Debit Card will not be issued for a minor below 10 years.

Question 11- Can I set transaction limits of my IPPB Rupay Debit Card from Mobile Banking App?

Answer- Yes, customers may set the transaction limit of Debit Card through Mobile banking app.

Question 12- Is there any minimum or maximum limit for the Card transaction?

Answer- Yes, The minimum transaction limit is Rs. 1. and the maximum transaction limit is 50,000/- (per day, per card).

Question 13- Can I block my Virtual Card at any time?

Answer- Yes, there is an option on the IPPB Mobile Banking application to block IPPB Virtual Debit card either temporarily or permanently. Customers may also approach the nearest IPPB bank branch working under post office to block the card.

Question 14- What is the difference between temporary blocking of card and permanent blocking of virtual cards and on which channels each is allowed?

Answer- Temporary blocking is to block the card on a temporary basis, which the customer may unblock later on at any time. However, in permanent blocking, the existing virtual card will be closed and can be no longer unblocked. In case of future use, the customer may generate a new virtual debit card once again.

![IPPB Credit Card apply online, launch with pnb bank [latest news]](https://blogger.googleusercontent.com/img/a/AVvXsEi6WtLdiYJGGzVuYawN1tPs99yXO5yVK3FTWlrFmqqRuCZb1UwmS_rZXoHWkMqK9wuQ8zaVi9XHqXpdc3NKg0GA8zH5Q490VkbaW_WKpXxF3FUV8xXXPuImEpqn3bh8-zdUOqPsMSr7w1hcudiWDsUcXZJMjS5NPIwIKuI2XE7_BB_cBud9_5EXeYkHkA=w680)

2 Comments

My debit card number

ReplyDeleteHame Mera card Nahi mil rha han new card danlowd Karna Han kese kre

ReplyDelete